The State of Play in Equipment Finance

It’s no secret that business owners often need some method of credit in order to purchase their capital equipment, whether it’s a CNC machine, a forklift or a medical diagnostics machine. These items can be expensive, and most business owners need the flexibility to pay for their purchase over the course of many years.

The challenge is that financing has a thorny way of becoming cumbersome and convoluted for both buyer and seller alike.

Enter the in-house finance arm:

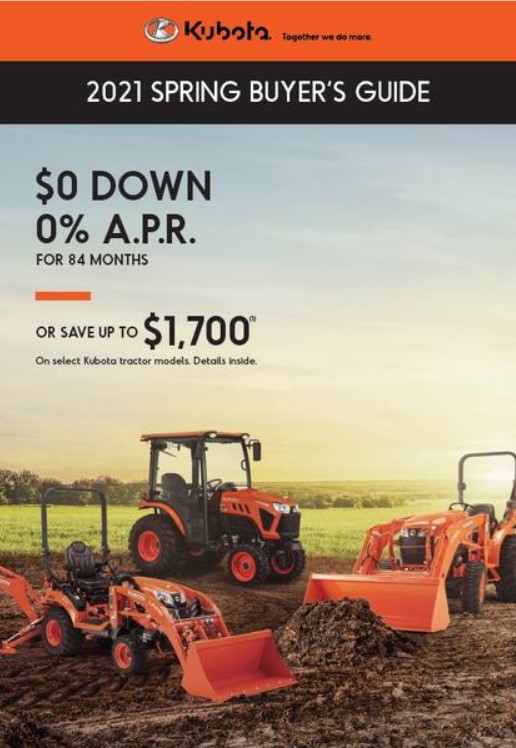

In order to remove friction from the financing process, the largest equipment manufacturers, from Caterpillar in construction, to John Deere in agriculture, to Stryker in medical, have all built in-house, or “captive” finance arms, to extend credit to their customers. They invest huge sums of capital, hire dozens of credit specialists, and build complex systems. . . all for one singular purpose: to use seamless financing as a lever to help their sales teams close more deals.

By bringing financing in-house, vendors provide a single credit application, certainty around approvals and certainty around the monthly payment.

This empowers their sales teams and dealers to lead with monthly payments rather than a single ticket price, turning financing into a superpower to boost their customer’s purchasing power, speed up their sales cycles and increase customer satisfaction.

The predicament for everyone else.

Small and midsize equipment vendors simply don’t have the bandwidth, expertise, or balance sheet necessary to build a finance arm from scratch. Instead, they are compelled to work with third-party lenders to offer their customers financing options.

The reality is that this structure is clunky and inefficient:

- Vendors need to build and maintain multiple lender relationships to offer wide enough credit coverage

- Sales reps don’t know which lender is the right match for each customer

- Customers need to fill out multiple (yet similar!) applications to get an approval

- Vendors relinquish control of a key part of the customer’s procurement experience

The result: multi-day financing cycles, suboptimal approvals and lost sales momentum.

It doesn’t need to be this way.

Financing should be an enabler; an accelerant for sales processes. Vendors deserve an in-house finance arm that helps them offer seamless financing to remove the hurdles around price and drive their sales.

Corbel: The modern equipment finance platform for all vendors.

If you are an equipment manufacturer, distributor, dealer or even a marketplace, Corbel is designed for you. Our platform enables you to spin up your own company-branded finance arm that gives you all of the benefits of a captive, without any of the headache.

Get your customers approved. Quickly.

In sales, time is money. With a single application your customers gain access to a network of top-tier lenders. Our technology prequalifies each customer and immediately matches them to the best fit, lowest cost provider. This ensures everyone gets approved and you maintain the sales momentum.

Regain control over the financing journey.

Corbel’s platform gives you full visibility into where your customers are in the financing process. No more chasing lenders to get updates on approvals. You have all the information at your fingertips and the monthly payment you need to close the deal.

Strengthen customer loyalty and LTV.

Nothing builds customer loyalty like an amazing experience around money. With a vendor-branded finance arm, you give your customers the ultimate payment flexibility they need to complete their purchase. Happy customers come back to spend more, and they spread the word.

Experience the Corbel advantage.

Offering seamless financing options is no longer a benefit that is only accessible to the largest players in the industry. Corbel’s platform enables vendors of all sizes to level the playing field with a fully integrated finance platform that looks, feels and acts just like an in-house finance arm.

Curious to see if this is a fit for you? Schedule a call with me today: